Salary Slip Format

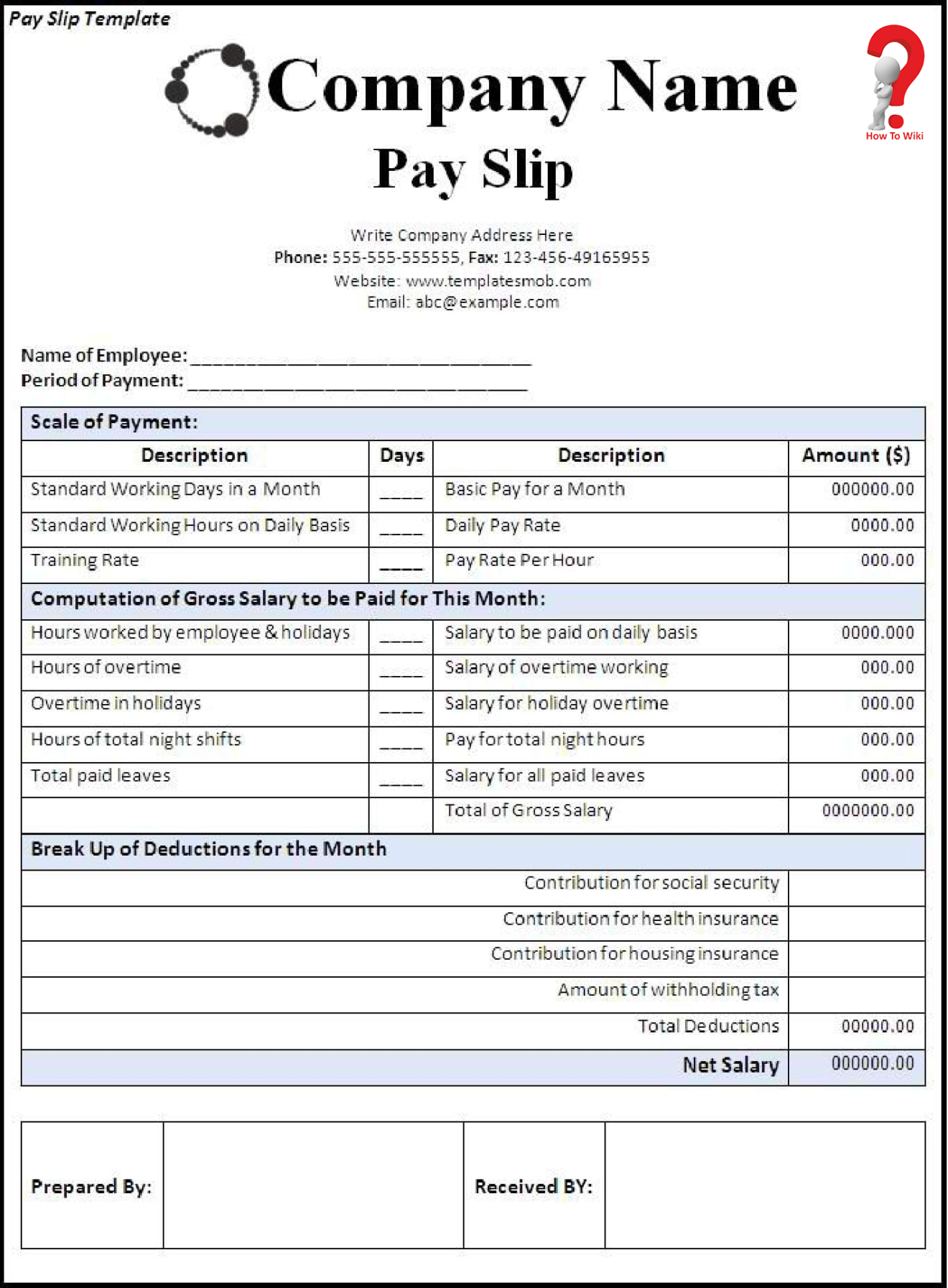

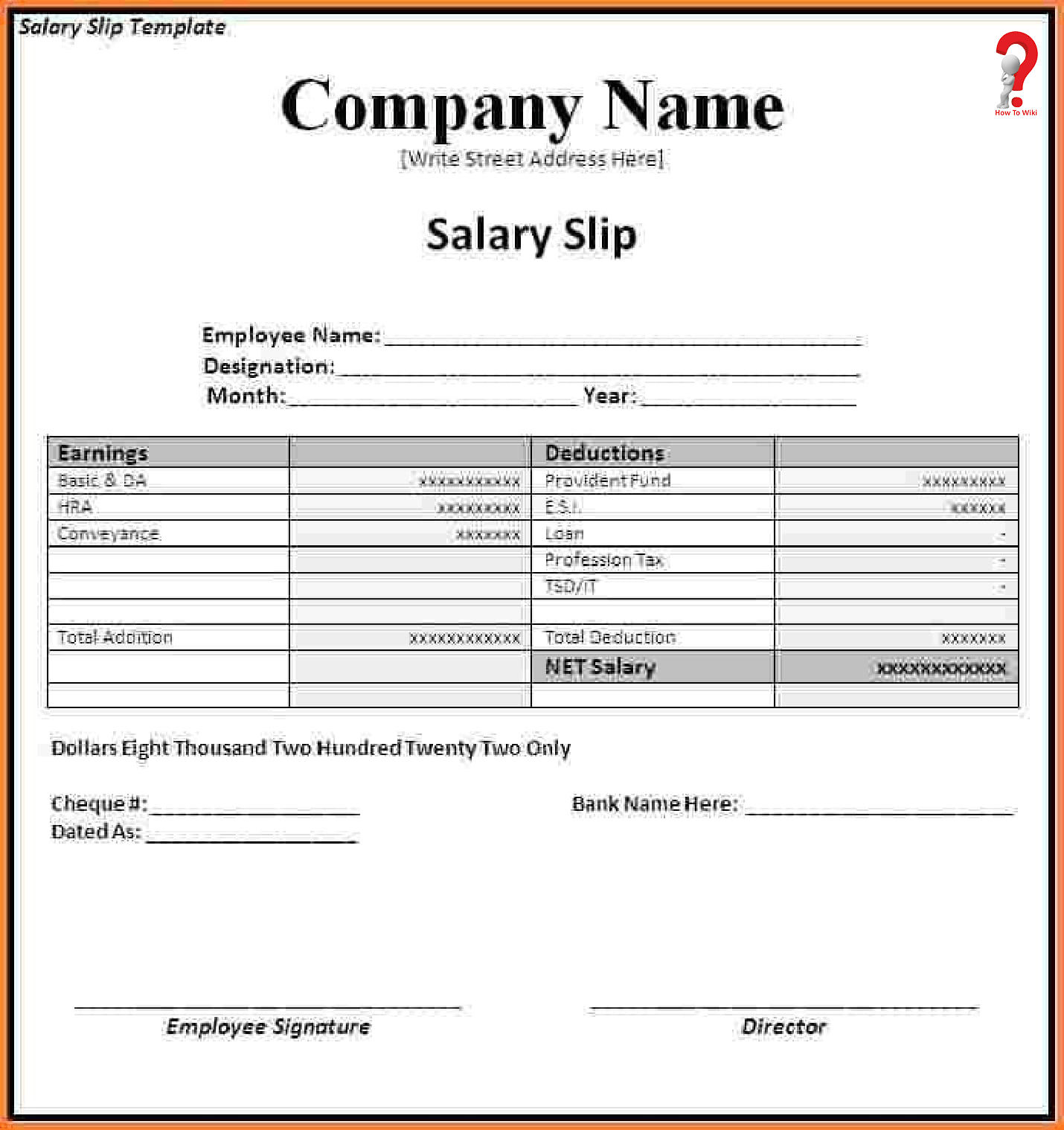

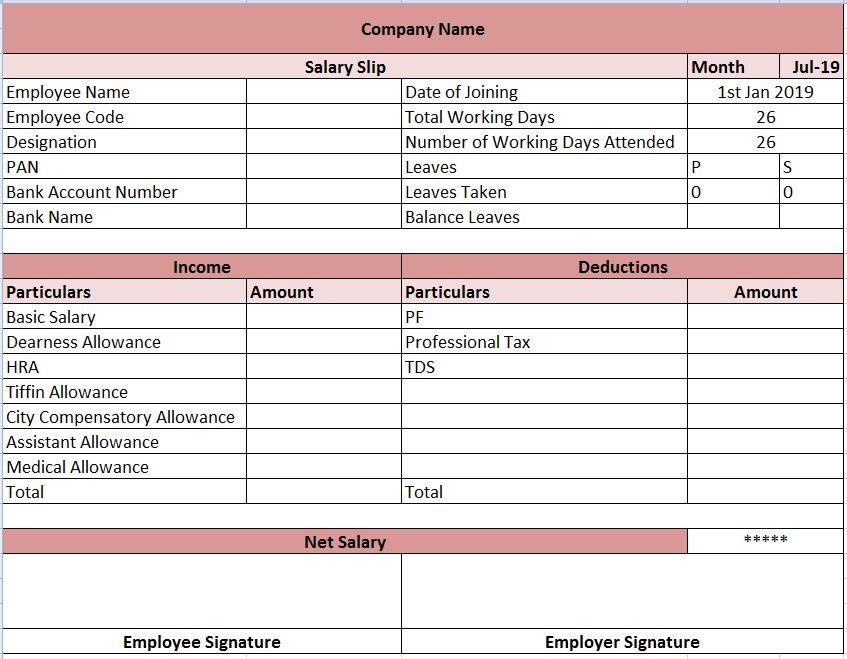

A salary slip can be defined as a document that contains the details of an employee's salary. These details include the basic pay, bonuses, deductions, etc., that are given to the employee every month by the employer. The employees often get soft copies of the same and sometimes are given hard copies as well. EXCEL FORMAT OF SIMPLE SALARY SLIP

How To Make Salary Slip Format in PDF, Excel, Word How To Wiki

The role of payslips Make payday a better day Xero Payroll eliminates the stress of payroll compliance by reducing manual calculations and errors. Automate the process and get time back. Pay and deductions are calculated for you Payslips are created automatically each payday Supports simple online tax reporting Check out Xero Payroll

9+ Salary Sheet Slip Formats Free Sample Templates

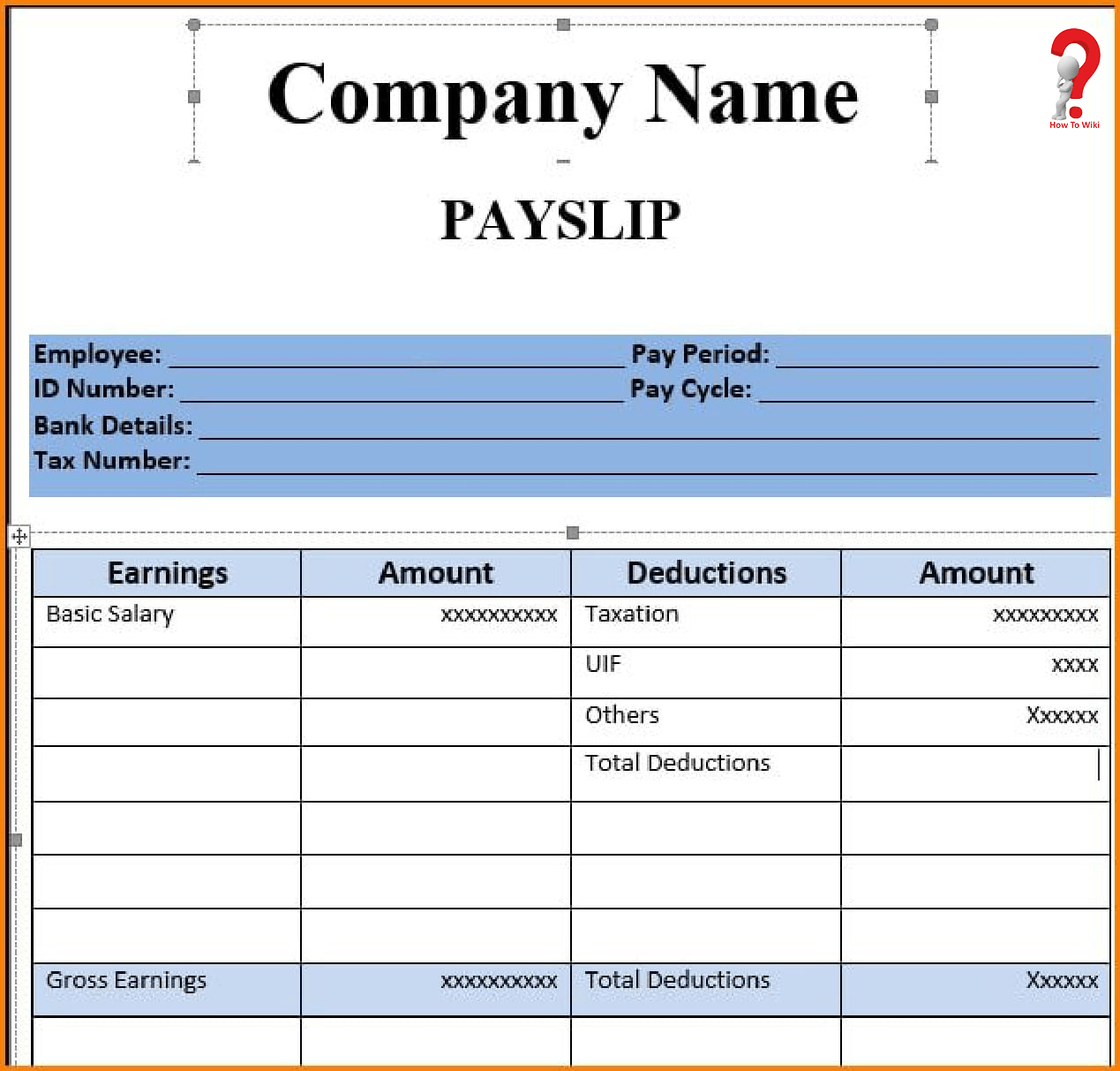

Best 23 Formats Of Salary Slip Templates. Sample Salary Slip Templates are added here for your help and reference. Salary Slip Template can be very much useful in your plans for making good quality and professional level salary slips. Salary is a payment to an employee from a company or an employer. Salary may specify in an employment contract.

Salary Slip Excel Templates

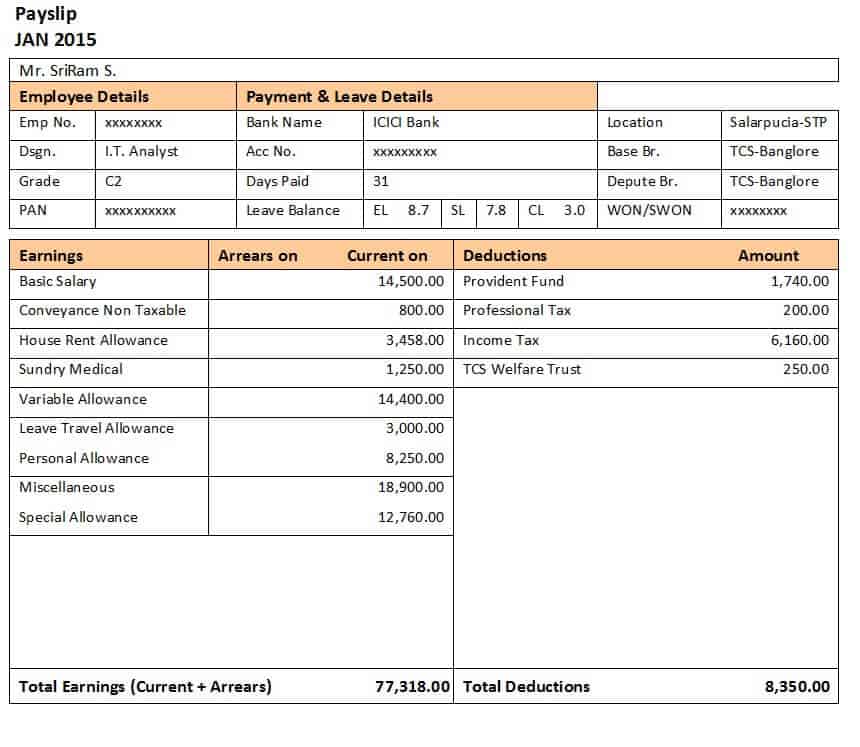

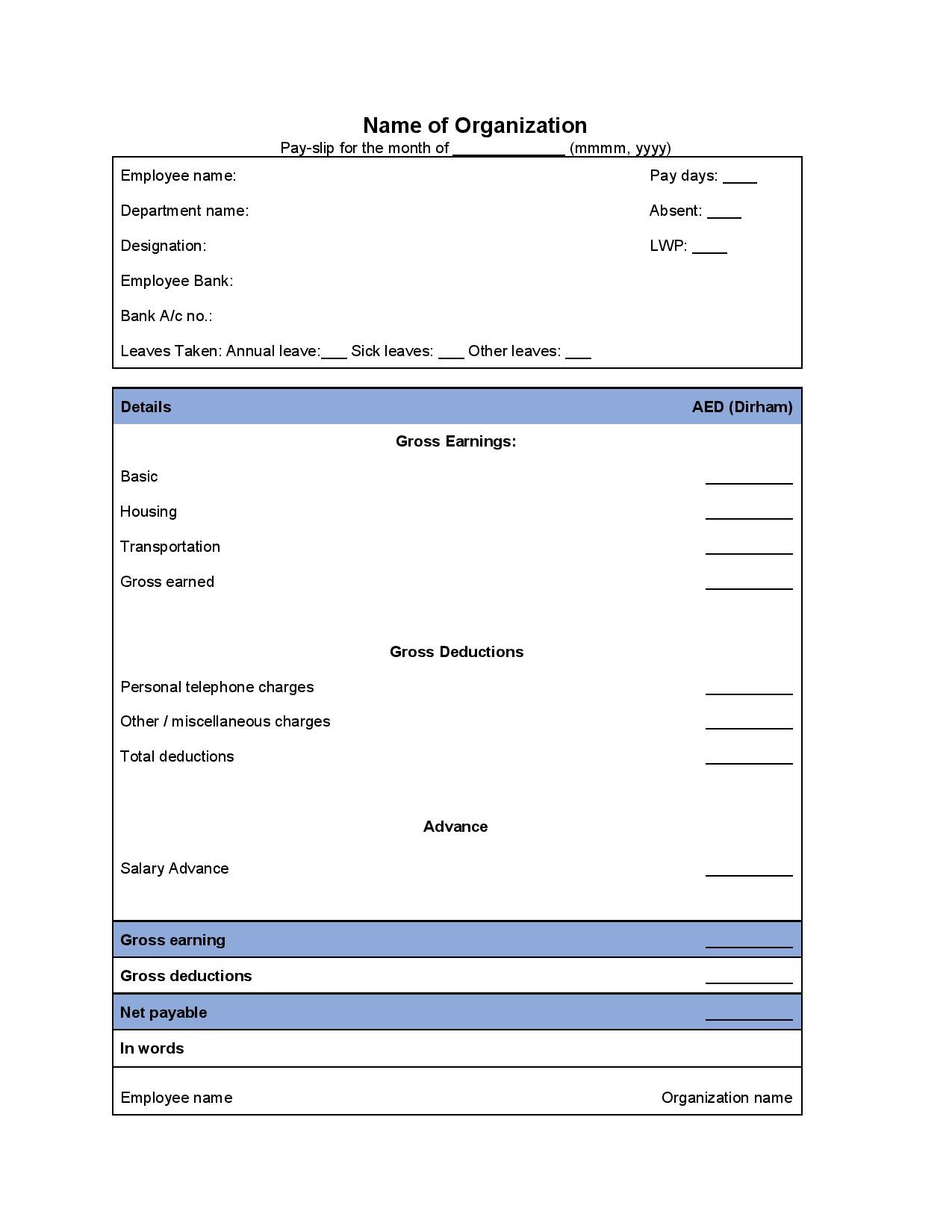

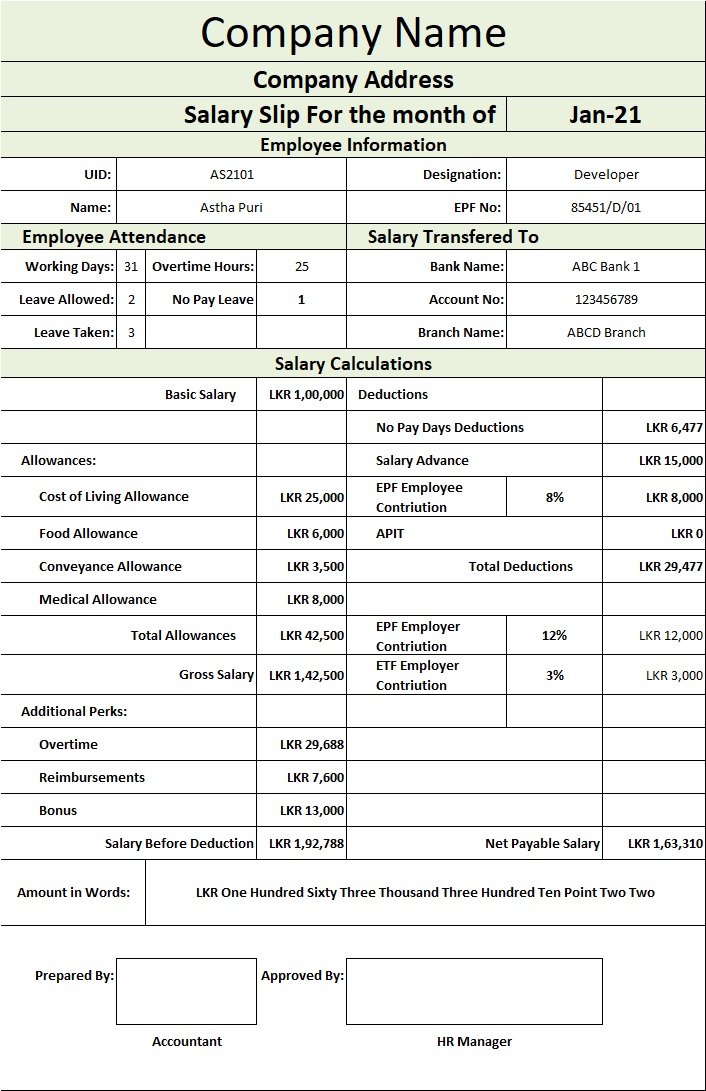

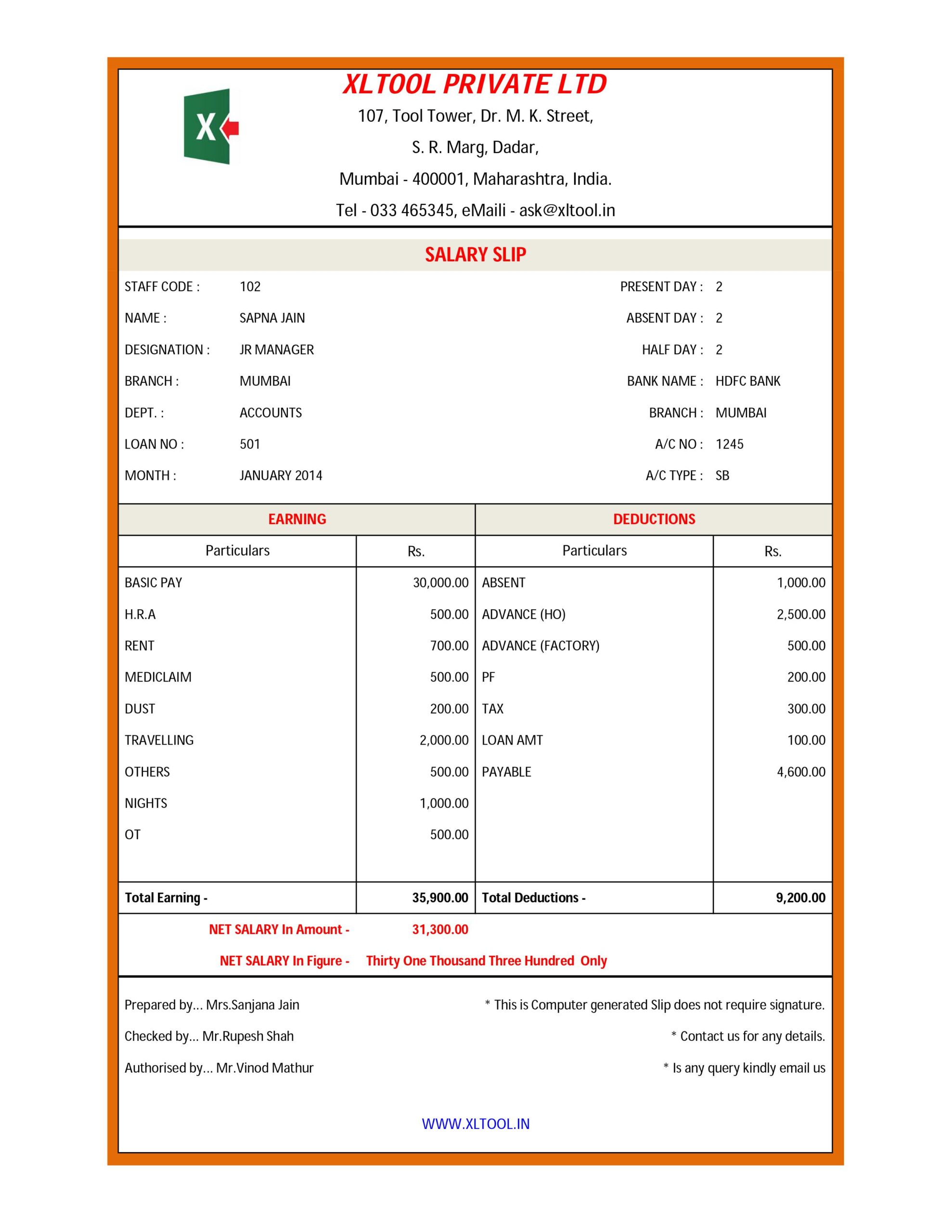

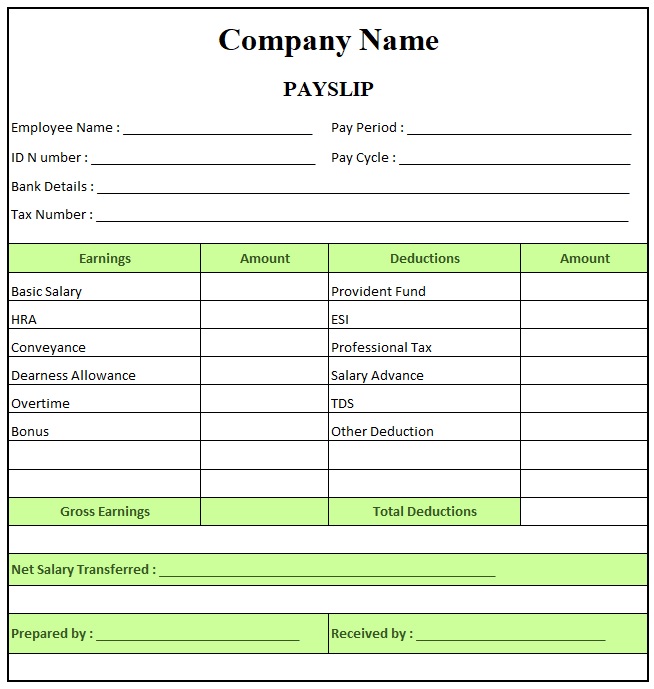

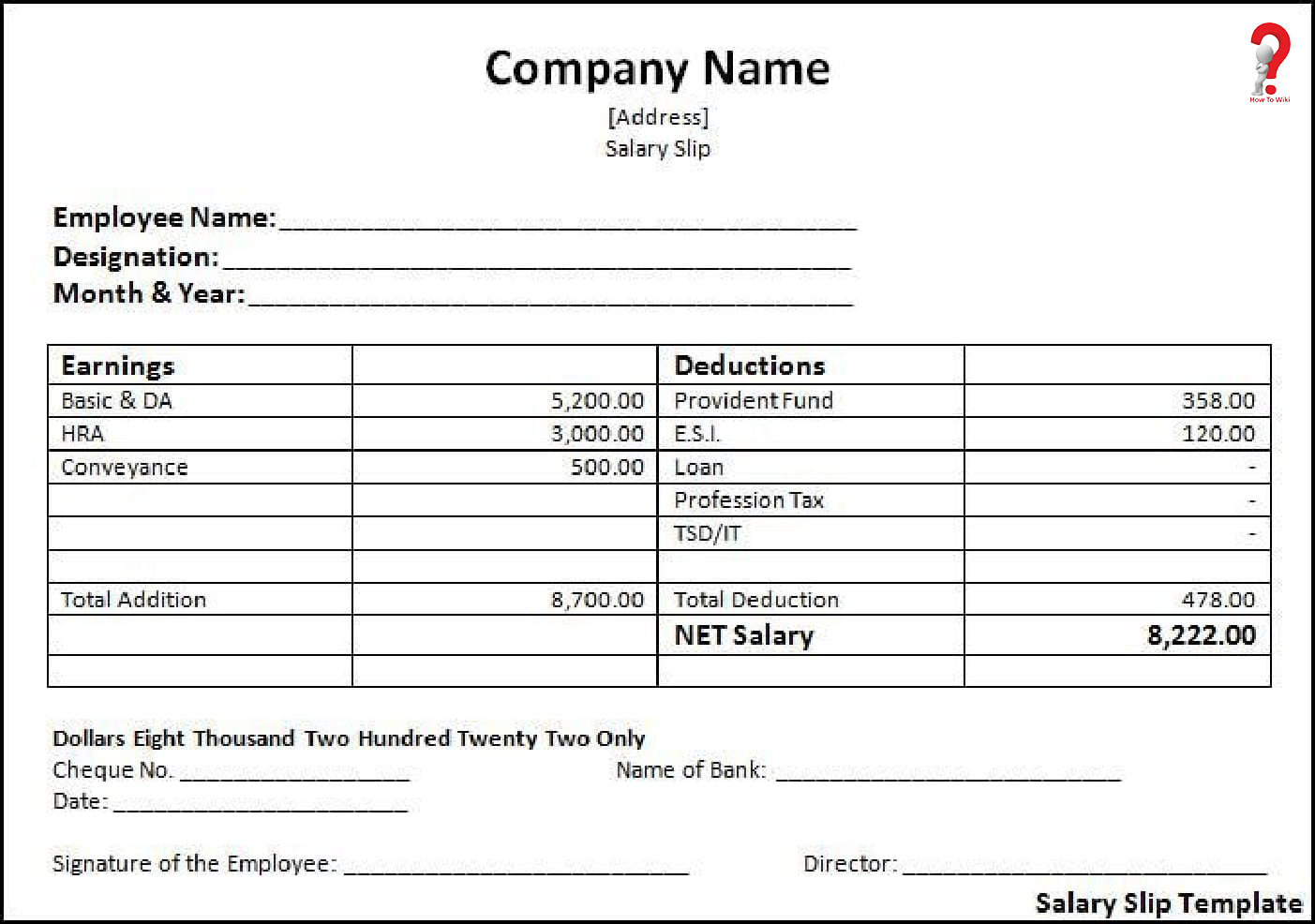

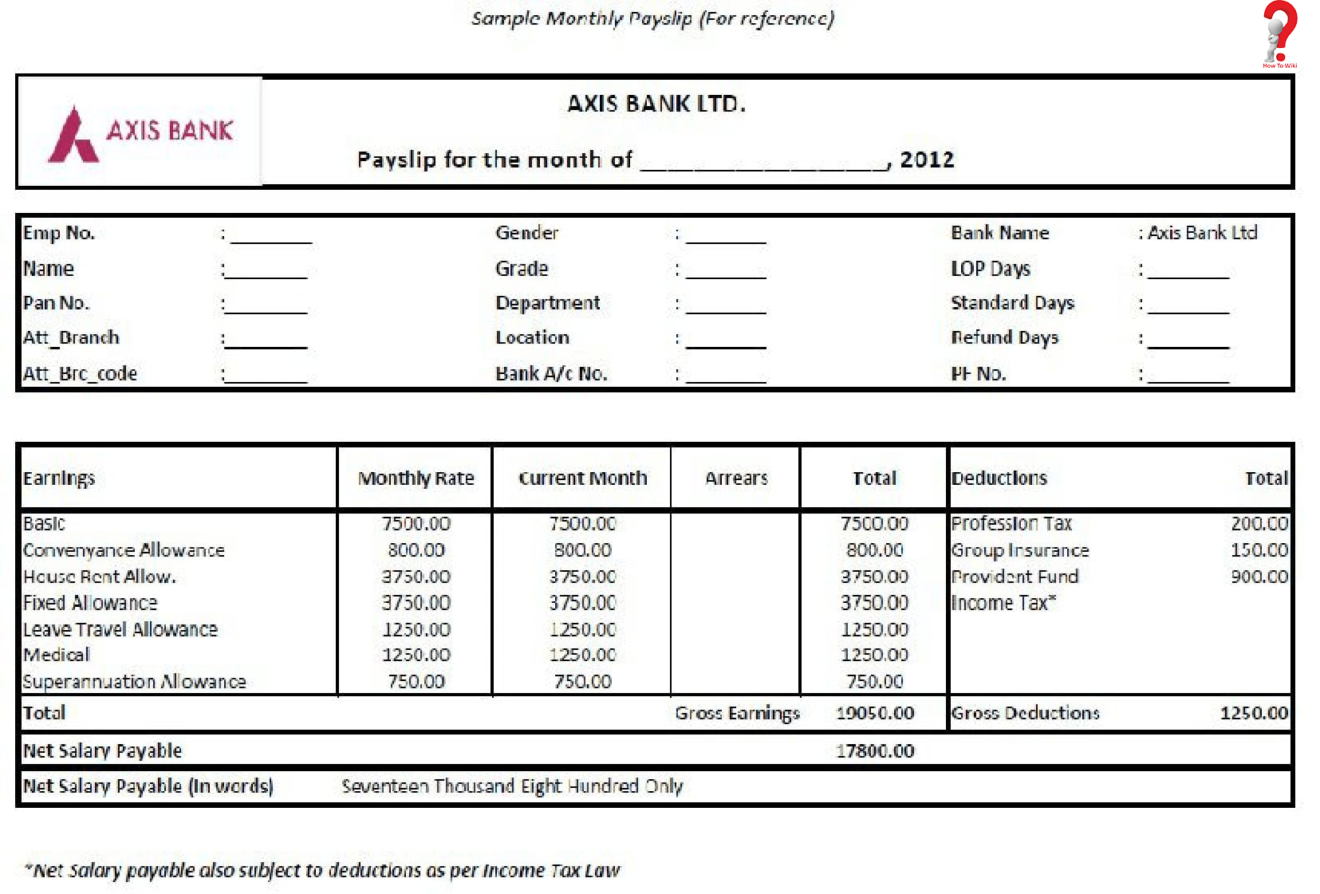

Salary slip is also called Payslips. Salary slips consist of the salary details of the employees, which include earnings like basic wage, HRA, Conveyance allowances, medical allowances, special allowances, and deductions like EPF, professional tax, TDS, and loan recovery details.

How To Make Salary Slip Format in PDF, Excel, Word HowToWiki

Print or download your customised payslip documents instantly. A full selection of payslip document templates for you and your business. [email protected] 0800 099 6395 PaySlip Maker. Home;. Different ways to pay; Instant email PDF preview; We can add extras to your payslip such as: Bonuses, Overtime, Pension, Department, Commission..

Top 20 Formats Of Salary Slip Templates Word Templates, Excel Templates

As the name suggests, the salary slip includes gross income, deductions, additions, and net income of the employee for a certain period i.e. 1 week 1 month, or 6 months. Key Elements of a Salary Slip: Name of the company/employer; Name of the employee; Date of preparing the salary slip; Period of salary slip i.e. from 1 st June to 30 th June

Salary Slip Format in Excel and Word

Payslip or salary slip template in Excel is the receipt given by the employer to their employees every month upon payment of salary to the employee for the services rendered in the month. A payslip consists of all kinds of earnings and deductions under various heads as per the norms given by the government in the respective financial year.

How To Make Salary Slip Format in PDF, Excel, Word HowToWiki

A Salary Slip Format is a single formal document that most comprehensively defines and manages the salary function by taking control of it. Contents hide.. Net Pay: Here, the payment received by the employee after all the necessary deductions are made, is declared. Lastly, important financial messages are also given usually below the slip.

Salary Slip Download Format, Components & Importance in UAE

Create a new row in the YTD worksheet. Enter all the information for a pay date, pay period, hours, and payment amounts. Select the pay date from the drop-down at the top of the free payslip template. The hours and amounts will update. Double-check, print and send the payslip to the employees.

Excel salary slip format lasopafind

A salary slip or pay slip will have basic information like company name, employee name, designation and employee code, etc. Salarys components primarily fall under two categories: Income/Earnings and Deductions.. Let's understand the difference between cost to company and gross salary with a sample pay slip. Mr. Charan's CTC is INR 5.

Slip Print Salary slip generator Excel format

Our free UK payslip template is modelled on the HMRC payslip form, making the payroll process much easier for companies.. Pay date, pay period, hours worked, pay rate (annual/hourly), tax period. Income and allowances: each and every one of the salary concepts generated by each worker that contributes to the amount to be received. It is made.

Employee Pay Slip 2023 Salary Details in New Format (PDF) Link ePayslip Online eSalary Slip

Salary Slip sheet Format in Excel: The simplest way to create a salary slip is by using Excel. You can use any worksheet in Excel, but you will need to enter your data into columns (the first column will be the name of your employee and the rest will be their work details). Salary slip Format in Word: If you prefer to use Word for your salary.

Simple Salary Slip Format For Small Organisation Pay Slip Format Excel

You can use the payroll calculator sheet as a pay stub, showing tax withholdings and other deductions, gross and net pay, and an itemized list of hours by type: regular, overtime, holiday, vacation, or sick time. Dashboard Payroll Template - Excel Download Dashboard Payroll Template - Excel

.png)

Salary Slip Format And Templates For HRs In 2023

Try Smartsheet Template . If you need a pay stub template with detailed hourly data, this Excel option shows an itemized list of hours worked and hourly rates based on the type of shift completed. Enter the type of hours worked, number of hours, and pay rates, and the template will calculate the totals. You can also itemize deductions, while.

How To Make Salary Slip Format in PDF, Excel, Word HowToWiki

A payslip is a statement that businesses provide to their employees with each payment they receive. This payslip informs the employee of their gross pay and what deductions were taken out to arrive at their net pay. It also provides an additional way for both the employer and employee to keep a record of their finances.

How To Make Salary Slip Format in PDF, Excel, Word How To Wiki

A UK payslip, also known as a salary slip, wage slip or pay stub, is a document given to an employee by their UK employer. Payslips detail the amount of pay given before tax, as well as deductions such as tax, insurance and other company schemes including pensions. Finally, it will state the amount the employee receives after these withholdings.